Stablecoin Wildcat – Evolution, Growth, Potentials of Revolutionizing the Financial World: Margex

2023 was a monumental year for the crypto industry and stablecoin market despite undergoing an instrumental shift and the challenges encountered by BUSD and USDC. The collapse and bankruptcy of central banks such as Silvergate and Silicon Valley Bank (SVB) led to significant instability, leading to Binance losing its license to issue BUSD with Silvergate. This also had a greater impact on USDC; it suffered a reduction in usage after de-pegging from USD due to exposure to Silicon Valley Bank (SVB).

Despite the challenging times for the stablecoin market in previous years, it was far from throwing in the towel. Instead, the stablecoin market continues to make great strides as big financial institutions and investors seek better and safer alternatives for transactions.

In recent times, stablecoins have emerged as one of the most innovative technologies in the cryptocurrency space and the financial world at large. With a market capitalization of over $173 billion, the stablecoin market is speculated to revolutionize the financial world and bring stability to traditional fiat currencies.

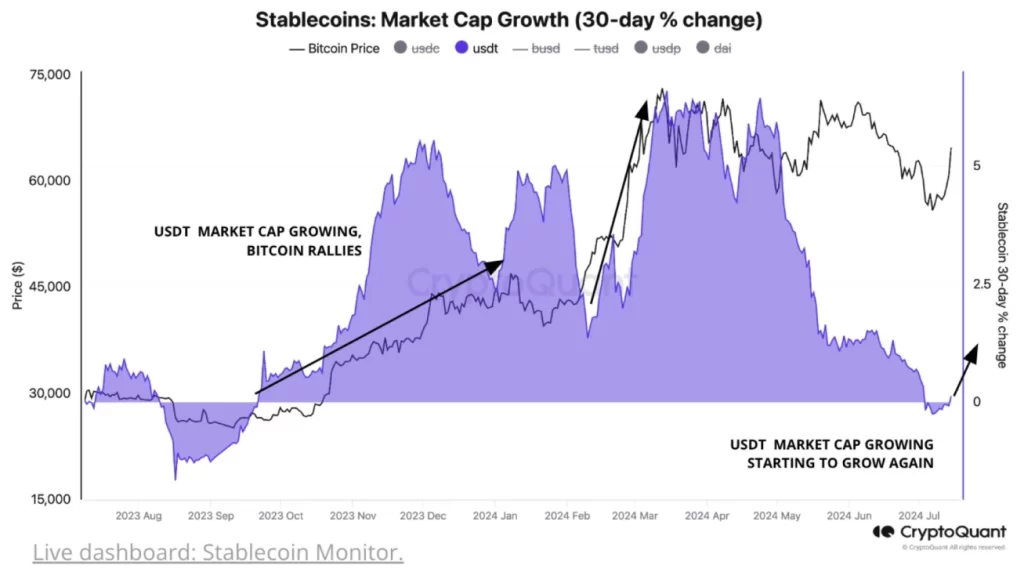

After witnessing substantial growth, 2023 to 2024 proved to be a special experience for the stablecoin market. Many factors highlighted the increase in demand, evolving technologies, and better regulatory policies favouring the stablecoin market.

This article expands on the evolution and growth of stablecoins, the policies shaping their landscape, and their potential to revolutionize the global financial system.

Dawn of Stablecoin Before the Boom Days

The cryptocurrency market and digital assets such as Bitcoin, Ethereum, and others are well known for their extremely volatile nature. In contrast, these digital assets provide many opportunities in the cryptocurrency market and financial world. However, due to their volatile nature, they make the possibility of transacting in the market and everyday store of value quite complicated.

In 2014, there was a need for a more stable digital asset with the creation of Tether (USDT), which pegged 1:1 with the United States dollar (USD), providing stability for financial transactions to be carried out worldwide.

Over the years, there have emerged more stablecoins in the market, including USD Coin (USDC), Dai (DAI), and others with these stablecoins adhering strictly to different models such as Fiat-collateralized stablecoins (backed by reserves of traditional assets, such as U.S. dollars or euros), Crypto-collateralized stablecoins (backed by other cryptocurrencies, requiring over-collateralization to account for the volatility of the underlying assets), and Algorithmic stablecoins (maintain their peg through algorithms that adjust supply based on demand).

In 2020, stablecoins began to gain popularity with the rise of decentralized finance (DeFi) and other technology in the cryptocurrency space, which facilitates transactions, liquidity provisions, and lending protocols for yield returns.

The stablecoin witnessed explosive growth in 2022. The total market capitalization of the stablecoin market skyrocketed to $28 billion in the early part of 2021, and towards the middle of 2022, the market rallied to $180 billion, leading to much adoption not just in the cryptocurrency space but also by institutions and corporate organizations developing interest in the digital space, making possible cross-border transactions and remittances.

DeFi protocols have played a key role in the integration of stablecoins as they have become a large share in liquidity provision, where users earn returns from various liquidity provisions and yield farming. However, the collapse of Terraluna in 2022 raised concerns about different models associated with stablecoin collateral and the need for policies to help minimize risk.

Policies Favoring Stablecoin Market Growth

Cryptocurrency has suffered much backlash in the past due to the lack of a proper regulatory body, but things are rapidly beginning to change for the cryptocurrency space and also for the stablecoin market as governments around the world are putting in place policies and regulatory bodies to help shape digital currencies.

These policies and bodies, such as MiCA (Markets in crypto-assets regulation) for Europe, have helped increase trust and adoption of digital currencies, with large financial institutions currently integrating stablecoins into their operations. More adoption would follow as digital assets help improve operational efficiency, reduce transaction costs, and have full access to decentralized financial services.

PayPal, JPMorgan, VISA, Mastercard, and others have all explored the use of stablecoin as a payment option, with other countries looking to leverage blockchain technology to create their own stablecoin in the form of CBDC (Central Bank Digital Currencies) as an alternative to its fiat currencies.

Institutional adoption is the catalyst needed for many to take advantage of the opportunities the cryptocurrency space provides. As institutions have identified these ways and begun leveraging them, there are many ways to take advantage of the cryptocurrency industry’s endless possibilities.

Copy trading in the cryptocurrency market has been identified as one of the fast-growing strategies many users and investors are leveraging to grow their portfolios while trying to learn more about the cryptocurrency industry and the opportunities it provides.

Margex platform, a leading crypto copy trading platform, allows all users to access endless crypto opportunities with little or no trading experience while they try to learn and develop better strategies to become more profitable.

Margex Copy Trading Opportunities with Easy Stablecoin Deposits and Withdrawal

Margex copy trading platform remains the top-leading platform designed for all users looking to change their game when it comes to copy trading in the crypto space. With its sleek design and high usability, users can easily navigate and start their trading journey.

Margex’s copy trading platform allows users to mirror the trades of experienced traders in the crypto space and diversify their portfolios to increase high-profitability opportunities.

Users on Margex can access top copy traders, strategies, asset allocations, equity, and risk tolerance to make informed decisions about their trading journey and which trader suits their personality.

To enable users to enjoy the best trading experience, Margex utilizes different features, such as a zero-fee converter to enable seamless swapping of crypto pairs and instant deposits and withdrawals with Stablecoins on the Kaspa and Margex TON network; these features are present on the Margex platform to help users trade better.

How to initiate your first copy trading journey on Margex platform with as low as $10;

1. Open a copy trading account with Margex

2. Deposit with as low as $10 using different deposit options such as Kaspa or Toncoin for fast deposit

3. Head over to the copy trading dashboard to follow your preferred trader

4. Decide on the amount you wish to initiate your copy trading experience

5. Confirm all processes above and click confirm to begin your journey to profitability.