$1 Million or Just 8% Gain? Experts split Bitcoin’s Future

In the minds of many investors, Bitcoin (BTC) is like a dream of wealth—a magical asset capable of growing hundreds of percent annually and sending its value “to the moon” with million-dollar price tags.

Analyst Willy Woo believes that Bitcoin’s boom times may be over. However, not everyone agrees.

Willy Woo predicts Bitcoin’s CAGR will decline and stabilize at 8%

Woo shared a chart titled “Bitcoin Annualised Returns,” showing that Bitcoin’s compound annual growth rate (CAGR) has dropped sharply, from over 100% in 2017 to around 30–40% after 2020.

That was the period when major institutions, including corporations and governments, began accumulating Bitcoin.

“People think BTC is like a magical unicorn that climbs to infinity on moonbeams. Here’s the actual CAGR chart. We are well past the 2017 year where we’d see many 100s of percent growth,” Willy Woo said.

Woo forecasts that Bitcoin’s CAGR will continue to decline over the next 15–20 years and eventually stabilize around 8%. This rate aligns with long-term monetary growth (5%) and GDP growth (3%). He emphasized that even with a lower CAGR, Bitcoin will still outperform most other publicly traded assets.

However, investor and author Fred Krueger disagreed. He pointed out that Bitcoin has already increased 7x from its December 2022 low, now trading at $103,000 as of May 2025.

Additionally, in a recent interview, Arthur Hayes went even further. He predicted that Bitcoin would reach $1 million before the end of Donald Trump’s current term. He expects the price to hit $250,000 by the end of 2025, representing a 1,000% increase in just four years.

GDP and liquidity growth seen as key drivers of Bitcoin’s future gains

Woo’s prediction is largely based on GDP expansion and monetary growth. Meanwhile, Paul Guerra, Head of Social at RealVision, offered deeper insights on the matter.

Discussing liquidity, he argued that traditional diversification strategies may no longer work in today’s market environment. That’s because assets like stocks, bonds, Bitcoin, and real estate now tend to move together, driven by a single key factor: liquidity.

“The true driver of markets is liquidity — the amount of money flowing through the system,” Paul said.

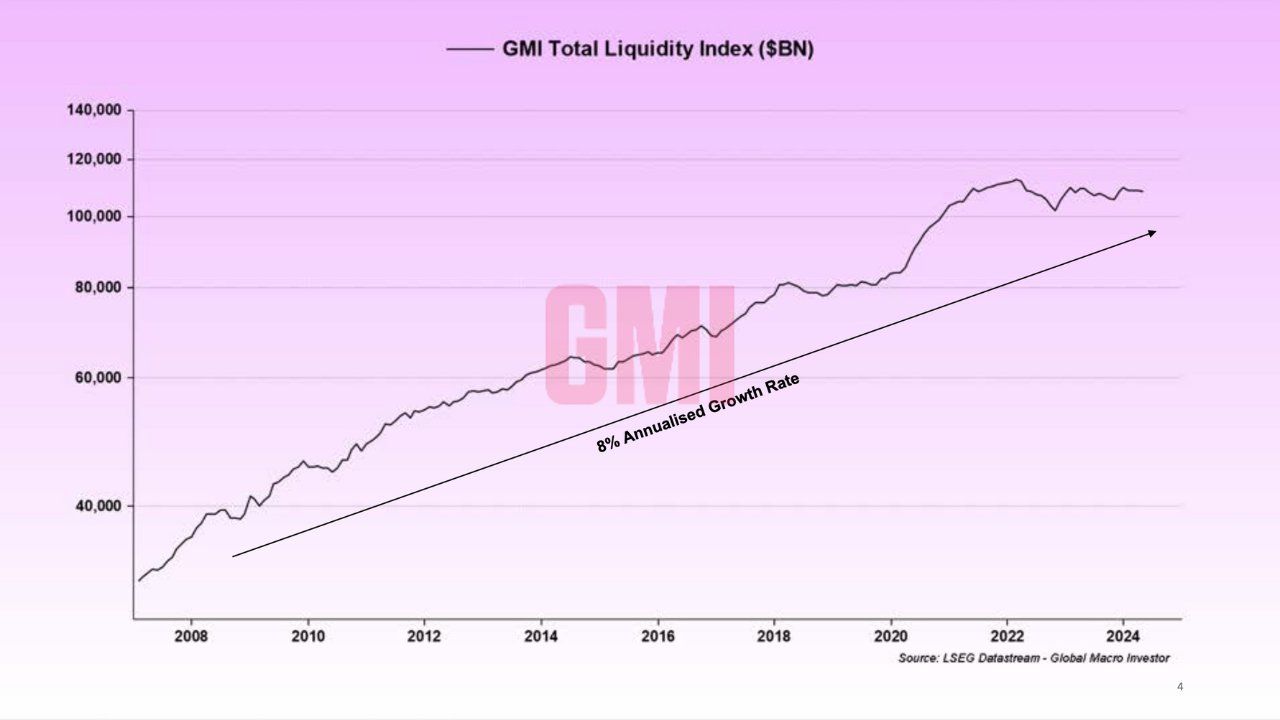

The Global Liquidity Index is currently growing at 8% annually. To understand liquidity, Paul suggested that we must first understand GDP. He presented a formula for GDP growth: GDP Growth = Population Growth + Productivity Growth + Debt Growth.

But today, population growth and productivity are declining worldwide. As a result, governments are being forced to inject liquidity to sustain GDP and support rising debt.

“Populations are AGING. Productivity gains are FLAT. Debt is EXPLODING. To keep GDP alive and service people’s debt, governments have only one tool: Pump liquidity,” Paul explained.

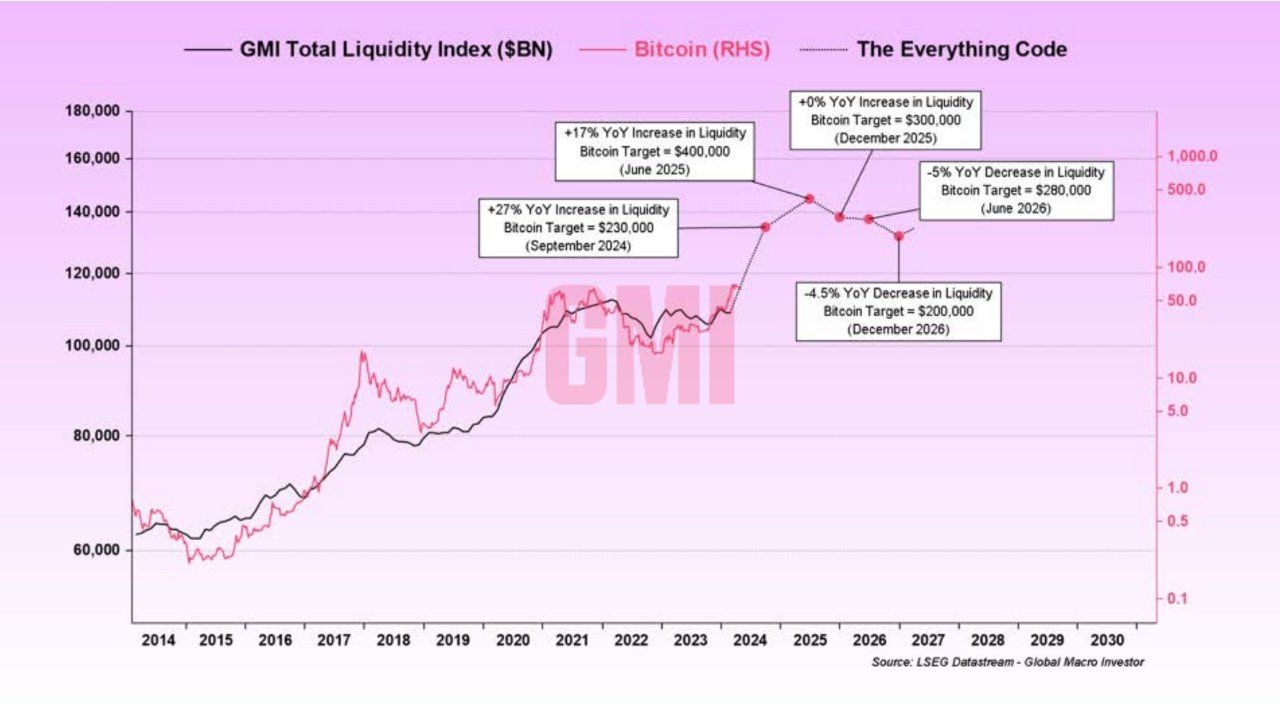

As a result, liquidity is expected to increase at an even faster rate. Paul predicted that Bitcoin could reach $300,000 by the end of 2025 and enter what he calls the “Banana Zone.” This term describes periods of massive asset price increases fueled by abundant liquidity.

Historical examples include Bitcoin’s 19,900% gain from 2013–2017, and Ethereum’s 699,900% surge in previous cycles.

Still, these analyses focus heavily on macroeconomic factors while overlooking potential technical risks. For instance, concerns are growing that advancements in quantum computing could threaten trust in Bitcoin’s long-term viability.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.